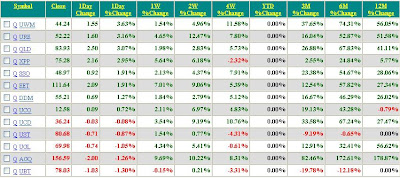

The table below of ETFs followed sorted by best performing ETF on a weekly basis shows AGQ the ultra silver ETF did the best on a one week percentage change basis up 3.01% but the real story is that it was up 7.70% on Friday as the market may have stopped its decline and begun a reversal to the upside. How this plays out we will just have to wait and see. Click on table to enlarge.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/base/copper-d.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)