The Market Volatility Index, known as the VIX, measures the volatility of the market. A recent news story described it as "the options market's gauge of investor fear." Traders use VIX as a general inverse indicator of market volatility and sentiment. High numbers mean that there's excess bearishness, and low numbers indicate excess bullishness. The VIX is updated intraday by the Chicago Board Options Exchange (CBOE), using Standard & Poors 500 Index (SPX) bid/ask quotes. The chart below of the VIX shows three notable spikes. The first spike at the end of January is associated with the revolution in Egypt, the second spike with the outbreak of fighting in Libia, and the third spike with the March 11th earthquake in Japan. Click on charts to enlarge.

The second chart below is of the S+P 500. Note how the high in the market corresponds to the second spike in the VIX and how the low in the market corresponds to the third spike. The VIX has declined since its March 16th high and the S+P 500 made its bottom on March 15, the Ides of March, and has risen since then just as the VIX has fallen.

The chart below is of the ERX, the energy bull ETF. Note how bullish this chart looks as it approaches a double top and potential breakout to the upside. If, however, oil prices decline so will this ETF. My feeling is that over the next few days oil prices will decline as the US Dollar strengthens. However, in this volatile world anything is possible.

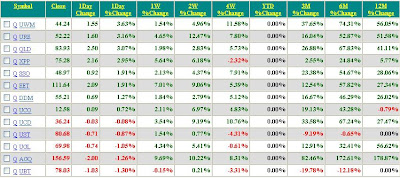

The table below shows the ETFs that are followed. AGQ, the Silver ETF, is up the most for the YTD period up 40.67% and up a whopping 12.23% for the week. The second place goes to DDM, ProShares Ultra Dow 30. Click on table to enlarge.